Trillium Asset Management is an impact driven, ESG focused investment firm with over $5.6 billion in assets under advisement as of 12/31/21. The firm delivers equity, fixed income, and alternative investments to institutions, intermediaries, high net worth individuals, and other charitable and non-profit organizations with the goal to provide positive impact, long-term value, and ‘social dividends’. With the aim of aligning stakeholders’ values and objectives, Trillium combines impactful investment solutions with active ownership. Headquartered in Boston, the firm opened its Edinburgh office in 2021 to manage a suite of global ESG-focused equities strategies. Continue reading

Artemis Positive Future Fund

Artemis was established in 1997 by a team that had worked together at Ivory & Sime,

Edinburgh. Artemis is an independent firm dedicated to asset management with AUM of £27

($37.45) billion. The firm has offices in Edinburgh and London; and sales offices in Munich

and Zurich.

In April 2021, Artemis launched the Positive Future Fund to invest in firms with the capacity

to effect positive change. The fund is managed by Craig Bonthron, Neil Goddin, Jonathan Parsons and Ryan Smith, who joined the business from Aegon Asset Management (formerly Kames Capital) in November 2020, where they managed the Aegon Global Sustainable Equity fund. The fund’s benchmark is the MSCI AC World and its active share is >99%.

What’s it like being Edinburgh-based, rather than London-based?

Edinburgh remains a vibrant place to be in the investment management business. In terms of

corporate access, we get better access in Edinburgh than we would if we were in London.

We compete for access with fewer institutions so get access to top management regularly.

Obviously, since Covid we do most things on-line so it in that sense it doesn’t matter where

we are located. Continue reading

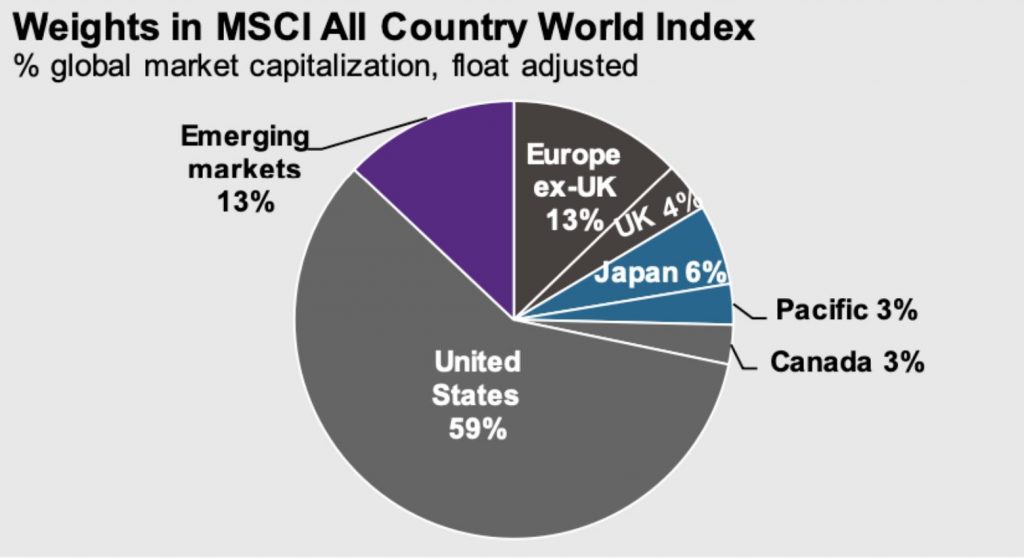

US equities continue to have by far the dominant share of global market capitalization

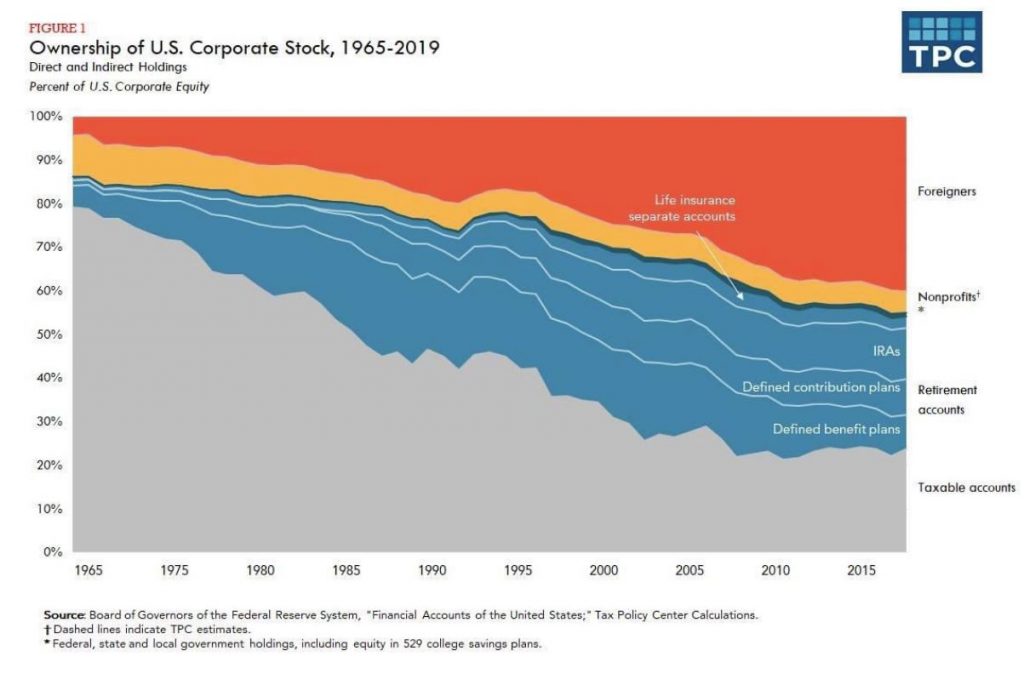

Ownership of U.S. equities

Independent Franchise Partners, LLP

Independent Franchise Partners, LLP was established in 2009 to offer the Franchise investment approach to institutional investors. The approach is based on the understanding that a concentrated portfolio of exceptionally high-quality companies, whose primary competitive advantage is supported by a dominant intangible asset, will earn attractive long-term returns with less than average volatility. This is particularly true when those investments are selected with an absolute value bias. Franchise Partners has AUM of $18.5 billion.

Hassan Elmasry, CFA Managing Partner, Lead Investor • 37 years’ experience • 19 years managing Franchise portfolios • Morgan Stanley, 1995-2009 • Previously at Mitchell Hutchins Asset Management and First Chicago Corporation • A.B. Economics; MBA, Finance, both from University of Chicago • Former co-chair and board member, Human Rights Watch.

Hassan Elmasry, CFA Managing Partner, Lead Investor • 37 years’ experience • 19 years managing Franchise portfolios • Morgan Stanley, 1995-2009 • Previously at Mitchell Hutchins Asset Management and First Chicago Corporation • A.B. Economics; MBA, Finance, both from University of Chicago • Former co-chair and board member, Human Rights Watch.

Since we last interviewed you in July 2009, AUM have risen from $250 million to $18.5 billion. Congratulations! How much larger will AUM grow?

We aim to grow our client base a little from here but not too much. Our priority has always been to protect our ability to generate attractive returns for our existing clients. Experience shows that larger size is the enemy of investment returns. We have always tried to manage asset growth very conservatively, even back when we were at Morgan Stanley. So, we have a couple of billion dollars of available capacity for new clients but no plans to dramatically increase assets.

Ownership of U.S. corporate stock, 1966 – 2019

Premier Miton Group plc – London

Premier Miton Group plc was formed in November 2019 from the merger of Premier Asset Management Group plc and Miton Group plc. The merger resulted in an active manager with $16 billion under management.

Nick Ford joined Premier Miton in December 2012 and co-manages the US Opportunities (AUM of $1.3 billion) and US Smaller Companies Funds ($458 million). Prior to this, he was at Scottish Widows Investment Partnership and before that co-manager of the Gartmore US Smaller Companies fund, manager of the US funds for Sun Alliance and Clerical Medical, as well as working at F&C Asset Management.

Nick Ford joined Premier Miton in December 2012 and co-manages the US Opportunities (AUM of $1.3 billion) and US Smaller Companies Funds ($458 million). Prior to this, he was at Scottish Widows Investment Partnership and before that co-manager of the Gartmore US Smaller Companies fund, manager of the US funds for Sun Alliance and Clerical Medical, as well as working at F&C Asset Management.

Hugh Grieves j oined Premier Miton in January 2013 and co-manages the US Opportunities and US Smaller Companies Funds. Prior to this, he was at Herald Investment Management. From 2000 – 2008 he co-managed the technology funds at SGAM and solely from 2008 – 2009. Prior to that, Hugh also worked in the US smaller companies team at Gartmore.

oined Premier Miton in January 2013 and co-manages the US Opportunities and US Smaller Companies Funds. Prior to this, he was at Herald Investment Management. From 2000 – 2008 he co-managed the technology funds at SGAM and solely from 2008 – 2009. Prior to that, Hugh also worked in the US smaller companies team at Gartmore.

What’s changed since the merger with Premier?

When we did the deal, Miton had $6.8 billion (£5 bn) AUM and that figure is now $16 billion.

How does Premier Miton differentiate itself?

We have a very high Active Share (94.3%). We are the only US multi cap fund. We focus on capital preservation and do not chase crazy valuations (e.g., we don’t own the FAANGs). We look very different to other funds and that works very well for clients looking to diversify risk.

Alantra – London

Alantra is a European financial services firm with a team of over 500 professionals, based in 35 offices in 25 countries. Within the Alternative Asset Management division, it has $2.6 billion (€2.2 bn) AUM in different asset classes, $12.9 billion (€10.7bn) AUM in FoF and $2.8 billion (€2.3bn) AUM in Private Wealth. In November 2020, the Alantra Global Technology Fund was launched.

Dr. Fiorangelo Salvatorelli is CIO/Founder of the Alantra Global Technology Fund. He has been an active technology investor for over 20 years, combining cross-disciplinary experience from consulting (Mckinsey & Co), long-only investing (Newton, Fidelity, CCLA), hedge fund management (Lansdowne, Kite Lake) and private equity (Fusion/Hermes) across multiple economic cycles and delivering a consistent investment performance track record. Dr Fiorangelo is a strong believer in the multi-decade trends in the technology industry, as well as driving superior risk-adjusted returns for investors. He was a former university lecturer at the University of Oxford Department of Engineering Science and INSEAD, and holds a MA and DPhil in Engineering Science from the University of Oxford.

Dr. Fiorangelo Salvatorelli is CIO/Founder of the Alantra Global Technology Fund. He has been an active technology investor for over 20 years, combining cross-disciplinary experience from consulting (Mckinsey & Co), long-only investing (Newton, Fidelity, CCLA), hedge fund management (Lansdowne, Kite Lake) and private equity (Fusion/Hermes) across multiple economic cycles and delivering a consistent investment performance track record. Dr Fiorangelo is a strong believer in the multi-decade trends in the technology industry, as well as driving superior risk-adjusted returns for investors. He was a former university lecturer at the University of Oxford Department of Engineering Science and INSEAD, and holds a MA and DPhil in Engineering Science from the University of Oxford.

Kulbinder Garcha is Portfolio Manager / Partner of the Alantra Global Technology Fund. Kulbinder has been analysing the technology industry since the late 1990s and is recognised as a top-ranked equity research analyst, having held positions at Morgan Stanley, Goldman Sachs and Credit Suisse. Most recently, he was head of Global TMT investing at the Qatar Investment Authority, overseeing the strong performance and material growth of the sovereign wealth fund’s technology, media and telecoms exposure across asset classes. Over more than 20 years, he has advised on numerous transactions, including IPOs, private equity, M&A, as well as activist investing across the industry. Kulbinder is focused on fundamental industry and company level analysis and has developed proprietary, data-driven thematic investing strategies. He holds an MA in Mathematics/Economics from Cambridge University.

Kulbinder Garcha is Portfolio Manager / Partner of the Alantra Global Technology Fund. Kulbinder has been analysing the technology industry since the late 1990s and is recognised as a top-ranked equity research analyst, having held positions at Morgan Stanley, Goldman Sachs and Credit Suisse. Most recently, he was head of Global TMT investing at the Qatar Investment Authority, overseeing the strong performance and material growth of the sovereign wealth fund’s technology, media and telecoms exposure across asset classes. Over more than 20 years, he has advised on numerous transactions, including IPOs, private equity, M&A, as well as activist investing across the industry. Kulbinder is focused on fundamental industry and company level analysis and has developed proprietary, data-driven thematic investing strategies. He holds an MA in Mathematics/Economics from Cambridge University.

How does the global technology fund fit within Alantra’s ecosystem?

Sycomore Asset Management – Paris

Joh an Söderström joined Sycomore Asset Management in May 2020 to co-manage the new Sustainable Technology fund. Previously he had been at Swedbank Robur for almost 10 years where he managed a large global technology fund (value >$7 billion as of 30.9.20). Before joining Swedbank, he was an analyst at H Lunden Kapitalforvaltning and a PM and analyst following tech at Brummer’s Manticore fund. He has a PhD in Finance from the Stockholm School of Economics (’02 – ‘07).

an Söderström joined Sycomore Asset Management in May 2020 to co-manage the new Sustainable Technology fund. Previously he had been at Swedbank Robur for almost 10 years where he managed a large global technology fund (value >$7 billion as of 30.9.20). Before joining Swedbank, he was an analyst at H Lunden Kapitalforvaltning and a PM and analyst following tech at Brummer’s Manticore fund. He has a PhD in Finance from the Stockholm School of Economics (’02 – ‘07).

Founded in 2001, Sycomore Asset Management is known for its responsible investing expertise, managing $7.9 billion (>€6.7 bn) in AUM through open-end funds and separate managed accounts. It has a proprietary model of fundamental business analysis aiming to identify drivers of sustainable growth. The Sycomore Sustainable Technology fund was launched in September 2020. The fund is managed by Johan Soderstrom and Gilles Sitbon alongside Sabrina Ritossa Fernandez, ESG specialist.

Where does Sycomore Asset Management sit within the Parisian investment management sector?

Hundreds of US companies fight new rules on hedge fund disclosure

Phoenix-IR wholeheartedly supports NIRI’s initiative to oppose the SEC’s 13F amendments proposal. Transparency is important and the SEC’s proposal goes in the opposite direction. It’s ironic that when companies are continuously being urged to be more transparent, the regulator would allow investors to become less transparent.

Hundreds of US companies fight new rules on hedge fund disclosure: https://www.ft.com/content/