Independent Franchise Partners, LLP was established in 2009 to offer the Franchise investment approach to institutional investors. The approach is based on the understanding that a concentrated portfolio of exceptionally high-quality companies, whose primary competitive advantage is supported by a dominant intangible asset, will earn attractive long-term returns with less than average volatility. This is particularly true when those investments are selected with an absolute value bias. Franchise Partners has AUM of $18.5 billion.

Hassan Elmasry, CFA Managing Partner, Lead Investor • 37 years’ experience • 19 years managing Franchise portfolios • Morgan Stanley, 1995-2009 • Previously at Mitchell Hutchins Asset Management and First Chicago Corporation • A.B. Economics; MBA, Finance, both from University of Chicago • Former co-chair and board member, Human Rights Watch.

Hassan Elmasry, CFA Managing Partner, Lead Investor • 37 years’ experience • 19 years managing Franchise portfolios • Morgan Stanley, 1995-2009 • Previously at Mitchell Hutchins Asset Management and First Chicago Corporation • A.B. Economics; MBA, Finance, both from University of Chicago • Former co-chair and board member, Human Rights Watch.

Since we last interviewed you in July 2009, AUM have risen from $250 million to $18.5 billion. Congratulations! How much larger will AUM grow?

We aim to grow our client base a little from here but not too much. Our priority has always been to protect our ability to generate attractive returns for our existing clients. Experience shows that larger size is the enemy of investment returns. We have always tried to manage asset growth very conservatively, even back when we were at Morgan Stanley. So, we have a couple of billion dollars of available capacity for new clients but no plans to dramatically increase assets.

Of the $18.5 billion AUM, all in equities?

Yes

Geographic split of AUM is 63% US, 5.2% APAC, 1.1% Euro, 27.7% UK, Switzerland and Norway? Why so little exposure to EU equities?

Geographic diversification is nice to have but is not a top priority for us.

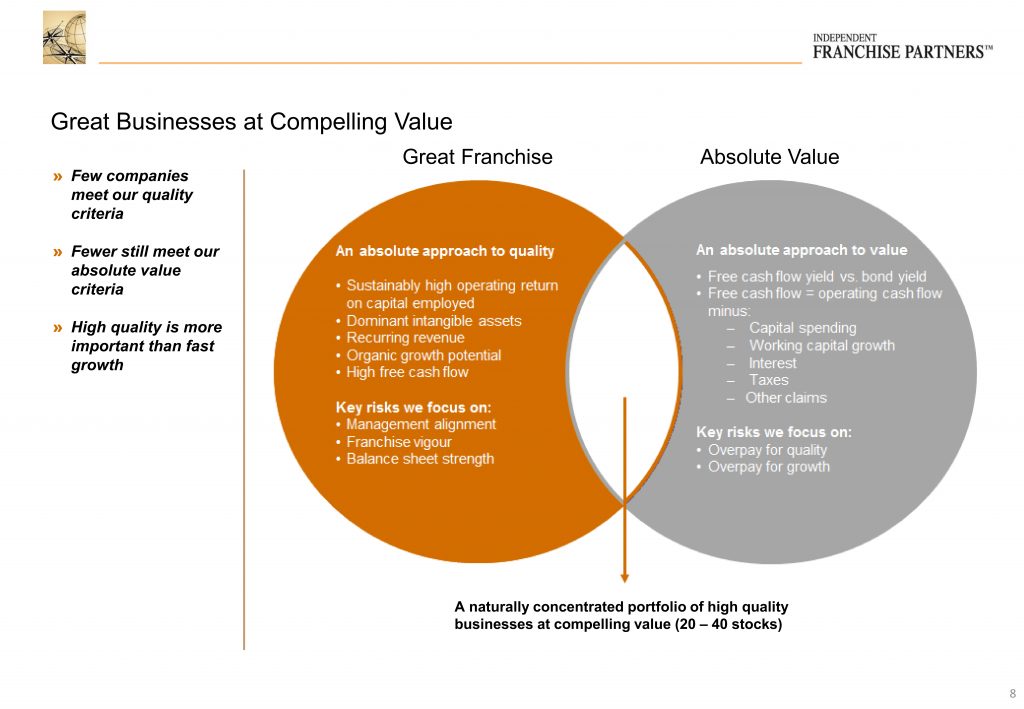

Our focus is to own high-quality businesses at attractive valuation. In particular, we look for very high-quality companies that are built around powerful brands, patents, trademarks, licenses, network effects, switching costs and other intangible assets. The most successful versions of that type of business are not evenly distributed around the world. That explains some of our geographic concentration. When we add our valuation criteria on top of that, it narrows the field further. In our experience, those two criteria are more important to controlling risk and earning attractive returns than geographic diversification.

There are six “investors” (fund managers) at Franchise Partners – do you split geographies and/or sectors?

No, we don’t think it makes sense for us to concentrate expertise by geography or sector. Our investors are all specialists in the franchise discipline itself and the very selective universe of roughly 160-180 companies that we follow closely. Within that tight universe, everybody follows a mix of companies across all industries and sectors. That focused universe and diversity of coverage responsibilities give us a richer debate when we come to make decisions.

Since 2009, what’s changed in the investment landscape?

So much!

As investors, the accelerating velocity of information and democratization of computing power has continued to make things more competitive. We think the key to winning in that environment is to have a sensible framework for making decisions and a long-term horizon.

At the same time, as investors and asset owners, all of us have benefitted from a remarkably benign market environment for a very long time – even the events of the last 15 months notwithstanding. Interest rates have generally been low. Monetary conditions have been very generous. Taxes have been low. Regulation hasn’t been particularly onerous. It has been a great time to be an asset owner.

And, the landscape has evolved at a more granular level too. For example, MIFID II caused an important reshuffling of the cards between the buy-side and the sell-side and created enormous pressure for sell-side firms.

The ascendancy of ESG has created an opportunity for long term investors to differentiate themselves from more speculative and shorter-term strategies. I think those are good things.

Things like the SPAC boom, the rich valuations software companies, those are just a function of the current generous liquidity conditions and probably not a long-term structural feature.

You now have an ESG specialist, how do you incorporate ESG into the investment process?

In a very real sense, we are not doing anything dramatically different here than what we were doing in 2009. Because we aim to be buy-and-hold investors, we have always cared about material long term risks – whether they are labelled ESG or not. Intuitively, a lot of ESG priorities make sense when your holding period is 5 or 10 years or longer.

What has changed for us – thanks to initiatives like CDP and TCFD and the more general rise of activist ESG agendas – is a mushrooming of corporate disclosure and independent measurement of these risks. Some of that is useful information and some of it is noise but, in any case, there is already more of it and even more coming. So, in early 2020, we hired an ESG expert to help us sift through and prioritize this massive amount of information and to help us refine the tools to navigate it.

You have large positions in two tobacco companies – how does that fit with today’s ESG environment?

Our approach to ESG is about the materiality of the risks to our investment and is not about an exclusionary approach. We do not, prima facie, exclude businesses for ESG reasons.

For clients who are tobacco sensitive, and there are many, we manage a tobacco-free version of our Global Franchise strategy. At only two years old, it is almost a quarter of our assets and the fastest growing part of our business.

In our Global Franchise and US Franchise portfolio, we assess risks on tobacco companies the same way we do with every other investment. That industry has proven itself to be quite resilient even before the arrival of next generation products like vaping and heated tobacco. We see those “reduced-risk” technologies creating additional runway in the durability of the business models of some of those companies.

How many companies in your investment universe?

Roughly 160 – 180. It is a pretty selective sub-set as there are >10,000 publicly listed companies in the world.

Investment style is to focus on “high quality franchises with a strong value orientation”.

• Focus on businesses built around durable intangible assets

• Avoid capital intensive businesses

• Strong bias towards absolute value

Average number of positions held?

31 positions in global and 26 in US portfolio. (Lot of overlap between the two).

Largest holdings?

~$1 billion in Philip Morris, BAT, News Corp, Fox, Novartis and Corteva.

Average position?

$600 million.

Franchise Partners weighted average market cap:

83% invested in mega cap ($20 billion +)

16% invested in large cap ($10 – $20 billion)

1% invested in small cap (<$3 billion)

What the figures above show is that we are agnostic about size. As long as a company has a robust, durable franchise, we are open to invest, irrespective of market cap. For example, companies like Informa or World Wrestling Entertainment are certainly not mega cap or even large caps. We were shareholders in MSCI when it was a $2-3 billion market cap. We were large shareholders in Kone when it was barely a mid-cap, the same for Estee Lauder, Chipotle, Moody’s, TransUnion, and S&P. Accessing that size of company is one of the reasons we are so careful about managing the size of our business.

Investment time horizon?

Ideally, our investment horizon is forever. We’ve owned BAT and Philip Morris for over 20 years, Novartis and Jonhson & Johnson for 10+ years. S&P we’ve owned now for 12-13 years. Same with eBay. Accenture we’ve owned for 16 years.

Do you vote your proxy?

Yes – As long-term investors, we think it is our responsibility to assess the proxy issues and make the voting decisions ourselves. We do the research and take advice, but we own the decision.

Discuss some of your largest holdings as all three (below) have classic franchise characteristic businesses.

Corteva – the intangible asset is a world-class portfolio of seed technology and germplasm that make their soybean and corn seeds some of the most productive globally. Their seeds generate meaningful incremental yield for farmers and Corteva captures some of that productivity increase in pricing. The seed industry has a well consolidated market structure. And as the ‘child’ of Dow and DuPont, spun off only a couple of years ago, there are some important benefits and commercial synergies that come from combining the two businesses and rationalizing. So, a good revenue profile, a supportive market structure and some further margin improvement from the consolidation of the operations. There is also significant margin opportunity as they substitute their own traits and germplasm for in-licensed IP and save on royalty costs. When you put those ingredients together, we see good potential for compounding the free cash flow.

Aon – the world’s premier insurance and reinsurance broker. The core of the franchise is the very durable commercial relationships between them and their insurance and reinsurance broking clients. The intangible assets here create sticky relationships and good pricing power. They have been terrific operators, steadily increasing margins for a long time. They are about to merge with Willis Towers Watson – which is going to give them an added layer of scale benefits, particularly in data for risk management and analytics. There is potential to strengthen the franchise by organizing and monetizing the risk and analytics data that flows through their business. They have started to do that, and we think there’s potential to take that further.

Richemont – the world’s number one “hard” luxury goods company with a focus on branded jewelry at Cartier and Van Cleef & Arpels and a broad portfolio of luxury watch brands. While they are a little bit more cyclical because of the obviously discretionary nature of the purchase, the brands have tremendous provenance and operate in a very attractive category.

What’s your view on corporate guidance?

In general, we think guidance should be simple, clear and long term. We see the value that guidance offers to investors and the signaling value that it can create internally for senior management.

Our biggest concern about guidance is when it gets complicated, overly detailed and short-term. That’s never a good sign and it rarely attracts the right kind of shareholders.

As investors, we are also sensitive to the risk that a company that is dominated by its targets or guidance may make commercial decisions to meet those short term goals rather than do the right thing for the business over the medium or long term.

Any companies that stand out as particularly good at guidance?

Companies like Nestle and L’Oréal and a long time ago, Gillette, really set the standard. We are always impressed by any company that can keep their guidance high level and longer term. We are even more impressed by those that offer no guidance at all.

Has the guidance culture changed since 2009?

Yes – as the sell-side has come under more pressure and struggled with the loss of experienced talent, companies have come under pressure to spoon feed ever more granular and frequent guidance. There has been a gradual juniorizing of talent on the sell-side over the last 20 years.

When meeting companies, do you always prefer one-on-ones, conferences and/or group meetings?

We attend conferences and groups meetings, but we value one-on-one engagement as we can set the agenda and ask questions that tend to be more strategic, longer term and focused more on a company’s capital allocation priorities.

Who do you prefer to meet? (e.g., C-suite, IR, line management)

All of the above. Engaging with knowledgeable and responsive IR can make a huge difference as we are putting together an information set and developing an investment thesis. Divisional managers can give depth on the business and corroborate or de-bunk important elements of the thesis. Obviously, CEOs and CFOs will have their own, quite useful, perspectives on the business too.

Any companies that stand out in terms of IR?

We’ve been lucky to work with some terrific IR people over the years. In many ways, IR teams have had to step up more as the sell-side has been there less and less.

In our experience, the quality of a company’s IR tends to change with personnel changes. For their size, Johnson & Johnson and Novartis have been consistently good, as have eBay and Experian. All of them very thoughtful and responsive in the way they approach shareholders.

Paul Alexander at Kimberley Clark, Nick Rolli at Philip Morris and John Peschier at CME stand out for a combination of time in the job, responsiveness, and deep knowledge of their business and sector.

We think very highly of TransUnion (although we are no longer holders) – the IR team there is very strategic, almost visionary in the way they communicated the transformation of that company. The team at S&P has navigated some pretty big changes and done it very very well.

Why should companies visit you?

I think we offer what they care about in their shareholders. We are a knowledgeable team where research and portfolio decisions are closely linked. We bring a long-term perspective and holding period. We buy in size.

How has the pandemic changed corporate access?

Probably in the same way it seems to have changed everything else. Corporate access is probably not going back to the pre-pandemic model – it is clear to everyone now that there was just too much waste – but it is also pretty clear that 100% virtual is missing something important too. I suspect the new normal after the pandemic will be mostly virtual – it is just so efficient – with some in-person around specific events or turning points for a company or their senior management.