Category Archives: 4) Markets

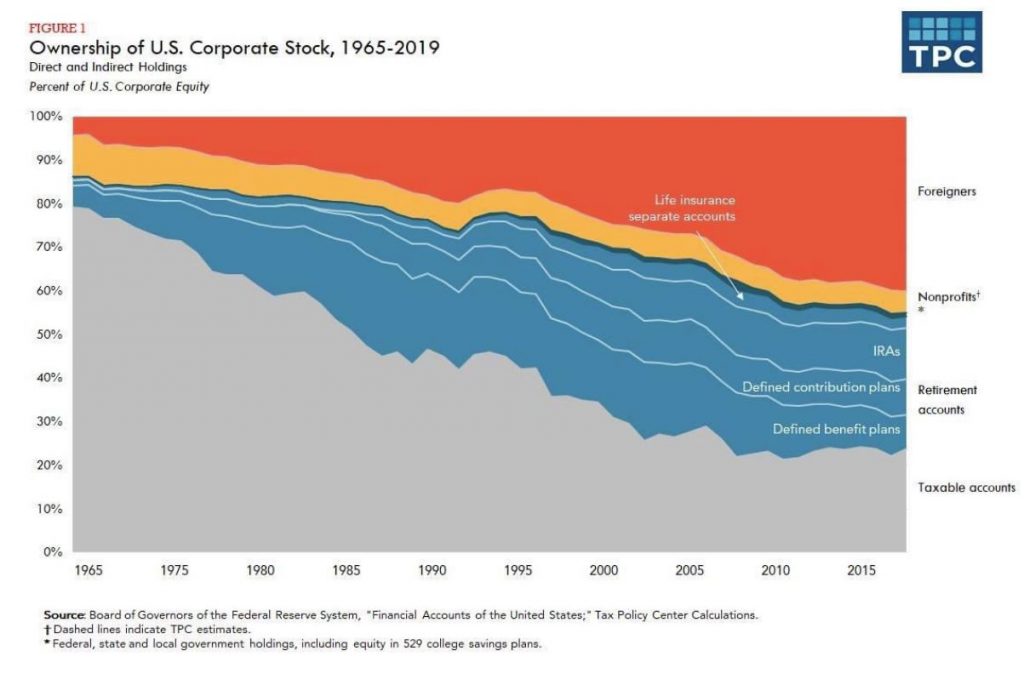

Ownership of U.S. equities

Ownership of U.S. corporate stock, 1966 – 2019

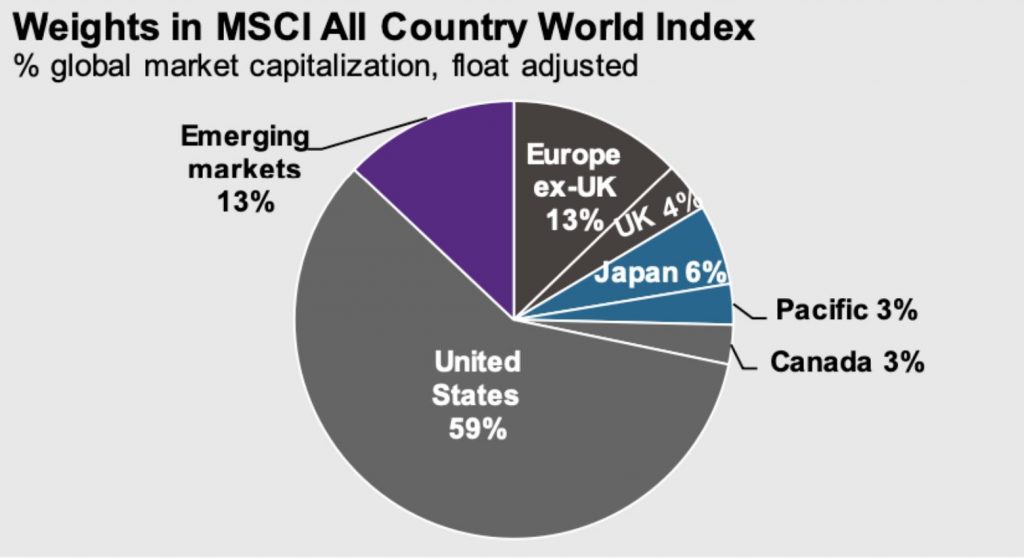

Any U.S. companies wondering whether they should communicate with international investors should consider this chart…..

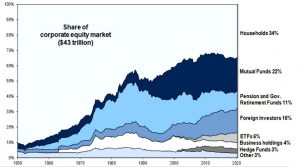

Foreign investors big buyers of U.S. equities

Overseas investors, who own 16% of the U.S. corporate equity market, bought $187 billion of shares during the three months through March, making them the biggest buyers of U.S. stocks during the first quarter of the year. Net corporate holdings increased by $129 billion and household purchases, including hedge funds, rose by $7 billion while pension funds and mutual funds sold a net $119 billion and $66 billion, respectively.

“Foreign investors will continue to be net buyers of U.S. stocks this year and will replace corporations as the largest source of equity demand (+$300 billion),” according to Goldman Sachs’ Portfolio Strategy Research team led by David Kostin. Goldman Sachs predicts net corporate equity demand will drop by 80% in 2020 to $100 billion as buybacks are suspended.

Source: Federal Reserve Board and Goldman Sachs Global Investment Research

BlackRock – Larry Fink’s annual CEO letter

Focusing on climate change, BlackRock’s CEO Larry Fink, in his annual letter to CEOs published January 12, 2020, urges companies to focus more on sustainability. He states that “Companies, investors, and governments must prepare for a significant reallocation of capital.”

Many of his comments are highly relevant for IROs.

Key takeaways:

BlackRock will not only double the number of sustainability ETS it manages but significantly, it will divest from its active portfolios those companies generating a quarter or more of their profits from thermal coal. Mindful of the economic, scientific, social and political realities of the energy transition BlackRock will not pursue an across-the-board sale of energy companies that produce fossil fuels.

BlackRock aims to increase its actively managed sustainability assets 10X from $90 billion today to $1 trillion in the next 10 years.

Earlier in January, BlackRock joined Climate Action 100+, a group of more than 370 investment managers with a combined $41 trillion in assets. Together the campaign’s members are pressuring the world’s biggest emitters of greenhouse gases to reduce their environmental impact and improve disclosure. BlackRock has placed environmental and climate risk among its top priorities for meetings with the public companies it owns.

“In the discussions BlackRock has with clients around the world, more and more of them are looking to reallocate their capital into sustainable strategies. If ten percent of global investors do so – or even five percent – we will witness massive capital shifts.“

“BlackRock announced a number of initiatives to place sustainability at the center of our investment approach, including: making sustainability integral to portfolio construction and risk management; exiting investments that present a high sustainability-related risk, such as thermal coal producers; launching new investment products that screen fossil fuels; and strengthening our commitment to sustainability and transparency in our investment stewardship activities.”

“We believe that all investors, along with regulators, insurers, and the public, need a clearer picture of how companies are managing sustainability-related questions. This data should extend beyond climate to questions around how each company serves its full set of stakeholders, such as the diversity of its workforce, the sustainability of its supply chain, or how well it protects its customers’ data. Each company’s prospects for growth are inextricable from its ability to operate sustainably and serve its full set of stakeholders.”

“While no framework is perfect, BlackRock believes that the Sustainability Accounting Standards Board (SASB) provides a clear set of standards for reporting sustainability information across a wide range of issues, from labor practices to data privacy to business ethics. For evaluating and reporting climate-related risks, as well as the related governance issues that are essential to managing them, the TCFD provides a valuable framework.”

“BlackRock has been engaging with companies for several years on their progress towards TCFD- and SASB-aligned reporting. This year, we are asking the companies that we invest in on behalf of our clients to: (1) publish a disclosure in line with industry-specific SASB guidelines by year-end, if you have not already done so, or disclose a similar set of data in a way that is relevant to your particular business; and (2) disclose climate-related risks in line with the TCFD’s recommendations, if you have not already done so. This should include your plan for operating under a scenario where the Paris Agreement’s goal of limiting global warming to less than two degrees is fully realized, as expressed by the TCFD guidelines.”

“We believe that when a company is not effectively addressing a material issue, its directors should be held accountable. Last year BlackRock voted against or withheld votes from 4,800 directors at 2,700 different companies. Where we feel companies and boards are not producing effective sustainability disclosures or implementing frameworks for managing these issues, we will hold board members accountable. Given the groundwork we have already laid engaging on disclosure, and the growing investment risks surrounding sustainability, we will be increasingly disposed to vote against management and board directors when companies are not making sufficient progress on sustainability-related disclosures and the business practices and plans underlying them.”

EFAMA – European Asset Management Statistics

“The EFAMA Asset Management in Europe report aims at providing facts and figures to gain a better understanding of the role of the European asset management industry. It takes a different approach from that of the other EFAMA research reports, on two grounds. Firstly, this report does not focus exclusively on investment funds, but it also analyses the assets that are managed by asset managers under the form of discretionary mandates. Secondly, the report focuses on the countries where the investment fund assets are managed rather than on the countries in which the funds are domiciled.

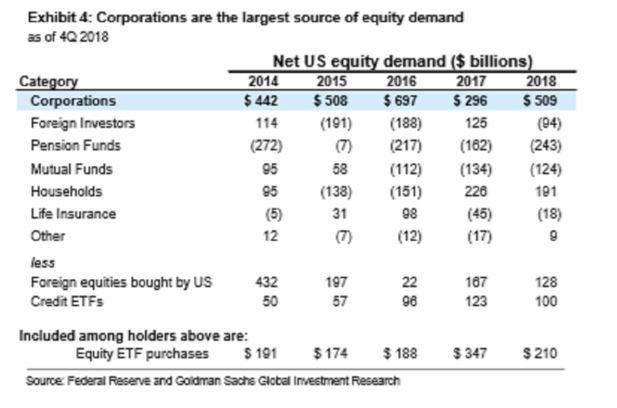

Corporate share buybacks

An interesting recent report from Goldman Sachs shows that share buybacks have been the largest source of U.S. equity demand during the last five years. Apparently, since 2010, net corporate buybacks averaged $420 billion annually, compared to only $10 billion each from households, mutual funds, pension funds and foreign investors.

According to a Bloomberg report, Goldman studied stock performance during earnings blackout periods, when discretionary buybacks are restricted beginning about five weeks before a company releases earnings, and then for two days afterwards. During the past 25 years, return dispersion and volatility during blackout windows have been higher compared with non-blackout periods: 16 percentage points versus 14 percentage points, and 16.4 points versus 15.8 points, respectively. Meanwhile, since buybacks have bolstered earnings per share by reducing the total stock outstanding, blocking repurchases would hurt growth in EPS. Over the past 15 years, the gap between EPS growth and earnings growth for the median S&P 500 company averaged 260 basis points. According to Goldman Sachs “In a world without buybacks, forward EPS growth could be trimmed by 250 bp,” a reduction that has historically corresponded to a 1 point decline in forward price-earnings multiples.

Larry Fink (BlackRock) – letter to CEOs

Larry Fink, the founder and CEO of BlackRock has written his annual letter to the CEOs of the companies in which the world’s biggest institution owns shares. In it he urges CEOs to consider the societal implications of their business decisions and to focus on their long-term plans. “To prosper over time, every company must not only deliver financial performance, but also show how it makes a positive contribution to society. Companies must benefit all of their stakeholders, including shareholders, employees, customers, and the communities in which they operate.”

He highlights BlackRock’s responsibility to engage with companies because index investors have become the ultimate long-term investors and he reaffirms his belief that companies are overly focused on the short term.

He calls for companies to articulate their strategy for long-term growth and explain their strategic framework for long-term value creation. “This is a particularly critical moment for companies to explain their long-term plans to investors.”

The letter, available below in full, is well worth reading…

https://www.blackrock.com/corporate/en-be/investor-relations/larry-fink-ceo-letter

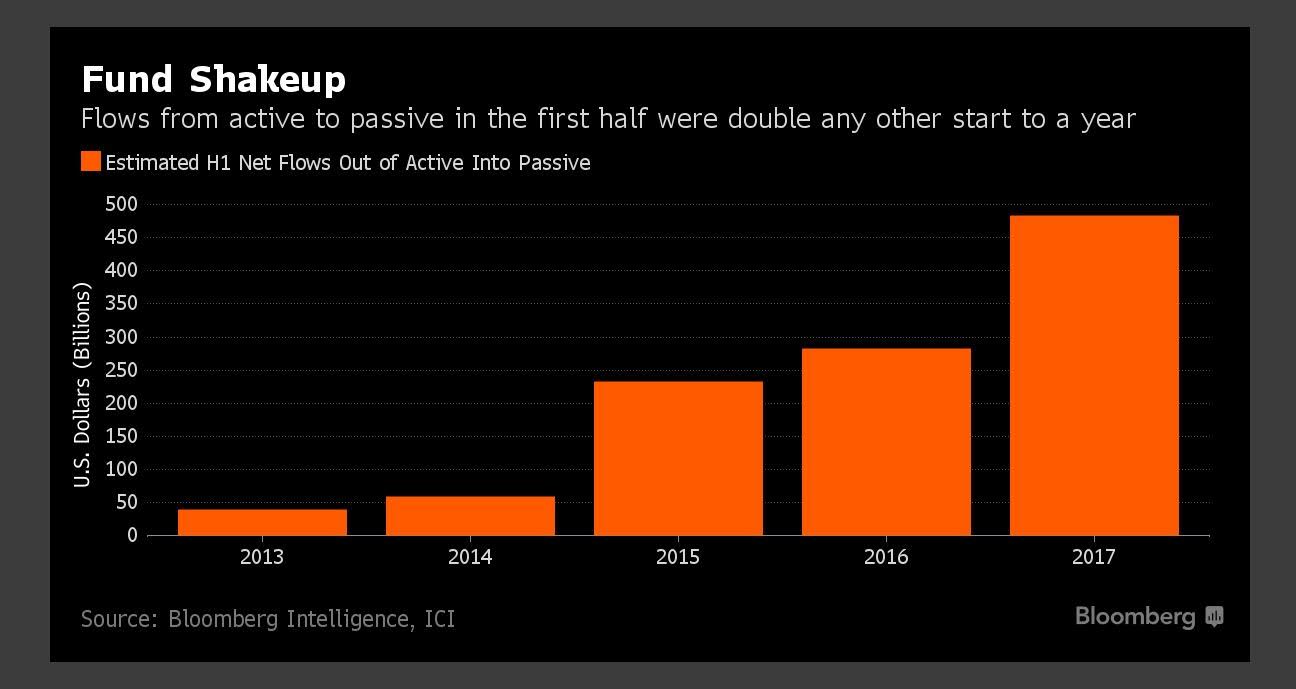

Fund Shakeup

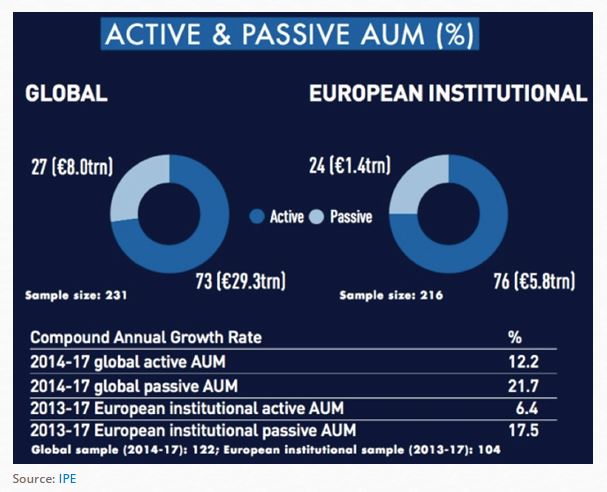

Active & Passive AUM (%)

Source: https://www.ipe.com/news/asset-managers/top-400-asset-managers-2017-global-passive-assets-hit-8trn/10019389.article