Premier Miton Group plc was formed in November 2019 from the merger of Premier Asset Management Group plc and Miton Group plc. The merger resulted in an active manager with $16 billion under management.

Nick Ford joined Premier Miton in December 2012 and co-manages the US Opportunities (AUM of $1.3 billion) and US Smaller Companies Funds ($458 million). Prior to this, he was at Scottish Widows Investment Partnership and before that co-manager of the Gartmore US Smaller Companies fund, manager of the US funds for Sun Alliance and Clerical Medical, as well as working at F&C Asset Management.

Nick Ford joined Premier Miton in December 2012 and co-manages the US Opportunities (AUM of $1.3 billion) and US Smaller Companies Funds ($458 million). Prior to this, he was at Scottish Widows Investment Partnership and before that co-manager of the Gartmore US Smaller Companies fund, manager of the US funds for Sun Alliance and Clerical Medical, as well as working at F&C Asset Management.

Hugh Grieves j oined Premier Miton in January 2013 and co-manages the US Opportunities and US Smaller Companies Funds. Prior to this, he was at Herald Investment Management. From 2000 – 2008 he co-managed the technology funds at SGAM and solely from 2008 – 2009. Prior to that, Hugh also worked in the US smaller companies team at Gartmore.

oined Premier Miton in January 2013 and co-manages the US Opportunities and US Smaller Companies Funds. Prior to this, he was at Herald Investment Management. From 2000 – 2008 he co-managed the technology funds at SGAM and solely from 2008 – 2009. Prior to that, Hugh also worked in the US smaller companies team at Gartmore.

What’s changed since the merger with Premier?

When we did the deal, Miton had $6.8 billion (£5 bn) AUM and that figure is now $16 billion.

How does Premier Miton differentiate itself?

We have a very high Active Share (94.3%). We are the only US multi cap fund. We focus on capital preservation and do not chase crazy valuations (e.g., we don’t own the FAANGs). We look very different to other funds and that works very well for clients looking to diversify risk.

How do you and Nick split sectors?

We both do everything although Nick tends to favour the smaller, higher growth companies. I tend to ‘play it safe’ and go for the stable, larger companies. So, a good balance.

Describe your investment style?

Multi cap, style agnostic with a capital preservation focus. Capital preservation is an important consideration for us.

What about not being invested in FAANGs given their outperformance?

We aim to invest in great companies when the valuation is depressed and hold them for a very long time. The FAANGs are really great businesses, great franchises with great cash flows, and great balance sheets but the question is how much risk are you taking? (given their valuations).

Quant screens?

We use two. CROCI is the amount of cash a business will generate vs. the cash put in. We look for >20%. We also look for leverage of no more than 3.5 times. We are not looking for businesses that require a high level of debt just to make the ROI work.

Qual screens?

Deep economic moat; Stable, asset light compounders; High level of recurring revenues; Ability to reinvest cash profitability into the business; High FCF conversion.

Our investment universe is the Russell 3000 so how do we narrow our focus and get to a portfolio of ~40 stocks? Our philosophy is that 85% of stocks in the US are uninvestible as they are too unpredictable, too complex or have too many variables. If a company’s internal finance department can’t put together a decent 3 – 4 year forecast given everything they know, then how are we, as outsiders, expected to do it? So, we concentrate on 15% of the market – consistent and predictable compounders which we are able to forecast, model and value with a reasonable level of confidence.

Also, we take out all the companies below $1 billion. And, there are certain sectors we dismiss. For example, the airline industry. Pretty much every airline in America has gone bust at least twice. It’s a terrible business, capital intensive, cyclical, low margin and it never returns free cash to shareholders. We don’t touch biotech either as it’s very binary – if the molecule works you make double your money, if it doesn’t you lose it all. We don’t invest in gold miners either (as we can’t predict the gold price for the next 10 years). We also dismiss companies that aren’t growing cash flows and revenues over time.

That leaves us with 1,100 names but Nick and I have spent 20 – 25 years kissing frogs and turning over stones. We look for a business that will generate increasing amounts of cash over time. Businesses with deep economic moats, that are very stable, often asset light/low capital expenditure, high level of recurring revenues and very transactional. Businesses you can’t live without. When we find them, we add them to our library of ideas. Stocks that one day we would like to own but at the right price. We look to hold those businesses for a very long time.

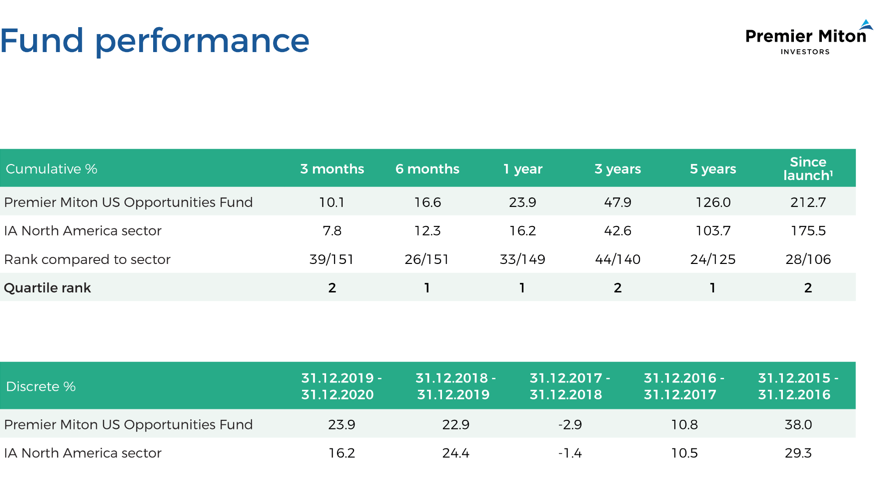

Performance

Investment horizon?

5, 6, 7 years. We very much view ourselves are long term, buying a company, tucking it into the portfolio and leaving it there.

Share price appreciation goal?

We look for double digit earnings growth and a total shareholder return in double digits.

Any sector restrictions due to ESG?

There are no formal restrictions, but we tend to prefer asset light names which have a much lower environmental impact. Tobacco, is not a growth sector. Defense has a concentrated customer base. So we don’t invest in those types of businesses.

How is ESG incorporated into the decision making process?

Governance is very important to us. It is important that management and shareholders’ interests are aligned. That starts with having a proper independent board who have the knowledge, confidence and ability to take tough decisions rather than just rubber stamp decisions made in the C-suite.

Buy backs or dividends?

Buy backs are like dating and companies tend to do buy backs when share prices are high. Dividends are like marriage. So, we prefer dividends.

Do you vote your proxy for foreign shares?

Yes – always.

Number of holdings?

44 currently. We usually have between 35 and 45 holdings.

Average position and largest position?

2 -3% = average with 5% largest

You are overweight Consumer Discretionary, Industrials and Financials vs S&P 500 – why?

We are overweight consumer discretionary as the fund is skewed towards more cyclical short duration businesses which is where we find the best value given the outlook for the economy. Mid and small caps tend to do well coming out of a recession (and sectors we favour tend to have more small/mid cap names). So, these indices that did badly going into recession are now starting to outperform (and have been since April of last year). History tells us that they should outperform for 3, 4, 5 years. From the perspective of running a multi cap US fund, that is a tremendous tailwind.

Underweight IT and communication services – why?

We don’t own any of the large cap tech stocks. They are too expensive and everybody owns them. It has been the only game in town. If rates start going up, that’s signalling a change in the market. People have made a lot of money so they don’t want to sell. It’s a great party – I get that. But once the police come to the front door (of the party), not everyone is going to be able to get out of the back door in time!

Talk about some of your holdings.

Pool Corp – it is the largest wholesaler to swimming pool contractors, supplying chemicals, equipment and accessories. It is 10 times the size of its nearest 10 competitors combined so it has economies of scale which it can pass on to its customers. The industry grows every year as people move South and build more swimming pools. Plus, you get a bit of inflation. Especially right now, because of lockdown, everyone is building swimming pools as fast as they can. If you wanted a pool now, you probably couldn’t get one till the end of next summer. It’s a great quality business. It has compounded EPS growth of 25% for > 20 years. So, a phenomenal track record. The business still has plenty of runway ahead of it. We’ve owned this stock since 2014.

Service Corp – is the largest player in funeral homes, cemeteries and crematoria in the US. It is the dominant provider, there is no competitor of any similar size. It’s a wonderfully steady business with high barriers to entry. If you own the only graveyard in town, you know nobody’s going to build one next to you! And one day everybody’s going to be a customer and each year you can charge a little more.

Any recent sales and why?

Analog Devices – a large semi company and a wonderful business, it’s doing very well. But at the moment, there are shortages of semis worldwide, customers double ordering and margins are close to record levels and valuations look very high. We thought we could put the capital to better use elsewhere and receive a better risk adjusted return.

Do you have to meet management before you buy a stock?

We don’t have to but It’s a very important part of the overall process. We are buying a part of the business, not a piece of paper to trade for a higher price later on.

Best companies at IR?

Those that are open and honest in good times and bad.

Why should corporates target Premier Miton?

We are long term and loyal holders. We are looking to build a relationship with management that lasts years.

How has move to a virtual world affected you?

I get to see a wider range of companies. Zoom meetings tend to be very focused and you get done in 40 minute what you used to get done in an hour. However, I do miss social interaction and look forward to seeing companies in their own boardrooms and factories, possibly by Q3.