Category Archives: 4) Markets

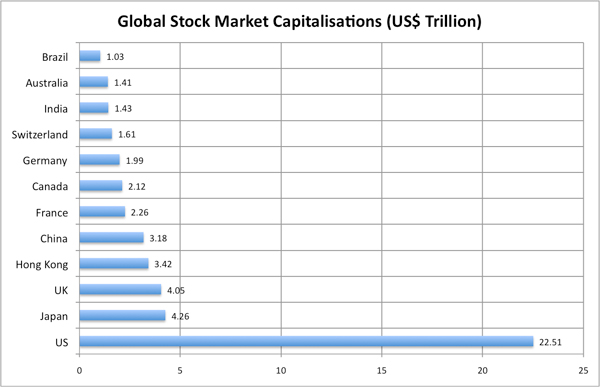

Goldman Sachs Market Cap comparison – U.S. vs. Europe

Goldman Sachs has made some interesting observations about the relative sizes of U.S. companies compared to Europeans.

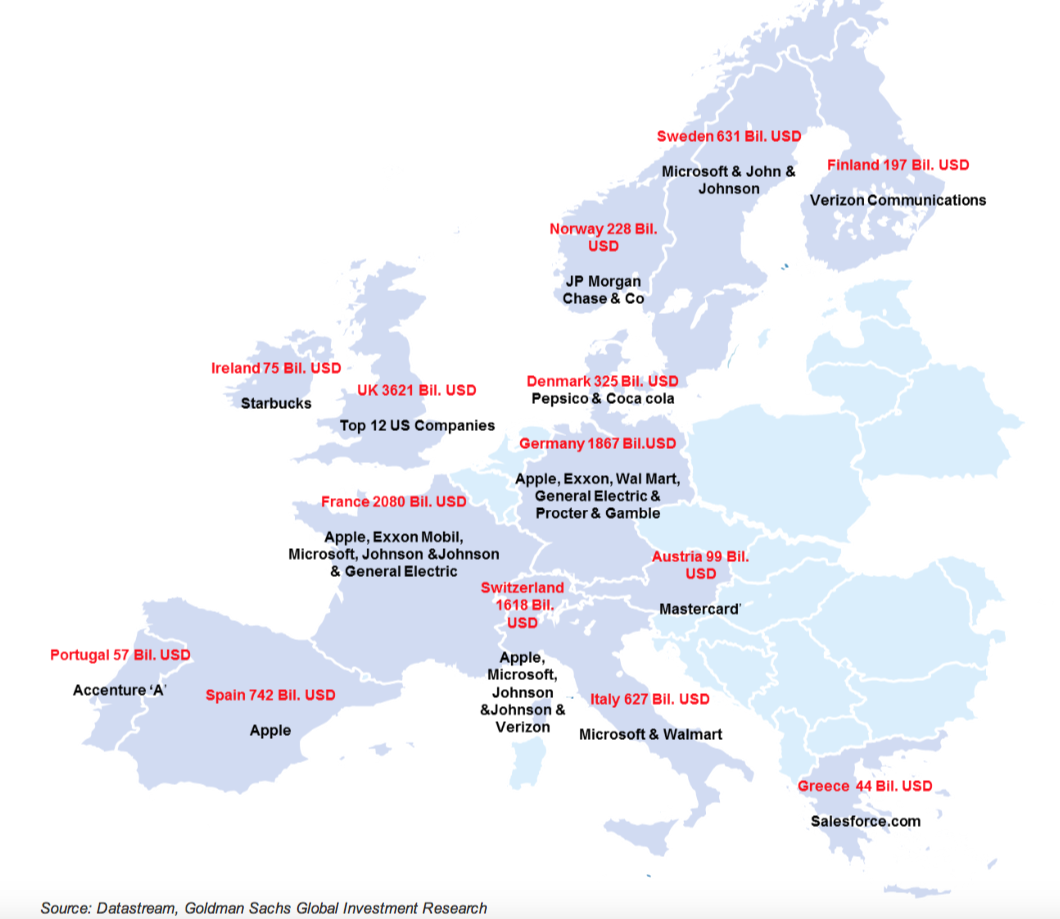

Here are some light hearted comparisons (based on total market capitalisation data)

- Apple alone is the same size as the whole Spanish equity market and bigger than Italy.

- The whole Italian stock market is worth about the same as Walmart and Microsoft combined the S&Ps 3rd and 6th biggest companies

- The German equity market (Europe’s biggest economy) is no bigger than the S&Ps 4 biggest companies

- The 40 biggest French companies (the CAC40) is no bigger than the US top 5

- Greece is no bigger than Salesforce.com, a company that has been public for a little over 10 years

- Starbucks is the same market capitalisation as the whole of Ireland

A US equity map of Europe – US companies shown in each country equate to the size of total market capitalization in the country Europe’s 600 biggest companies (the Stoxx600) are less than half the size of the S&P 500.

Europe’s 600 biggest companies (the Stoxx600) are less than half the size of the S&P 500.

It’s also interesting that even in the context of Europe the Swiss market alone is bigger than Spain and the Netherlands combined. The UK 100 biggest companies (FTSE 100) are bigger than the CAC and Dax put together.

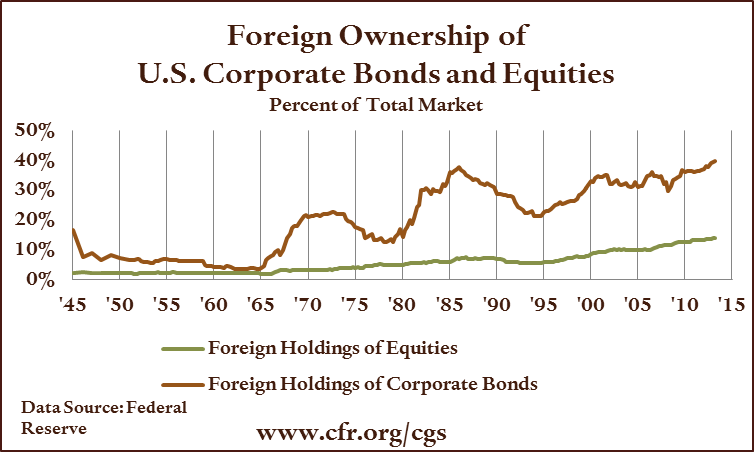

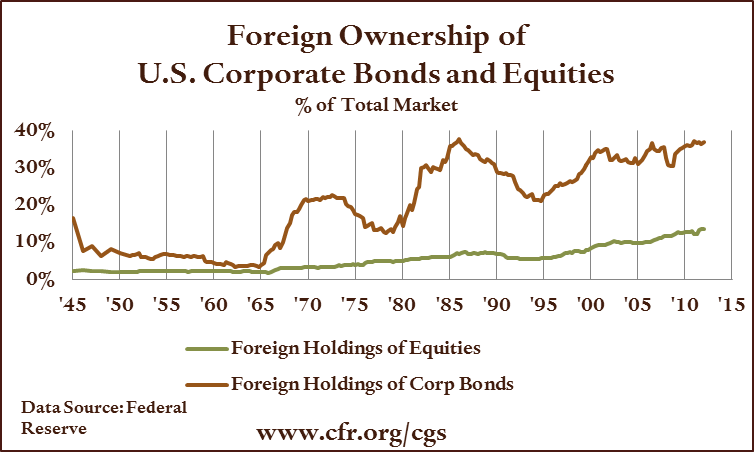

Foreign ownership of U.S. equities

- Since 1985, foreigners have consistently owned more U.S. assets than Americans own foreign assets

- International investors own approximately 15% of the U.S. equity market

- U.S. total market cap is approximately $25 trillion, so 15% = $3.75 trillion

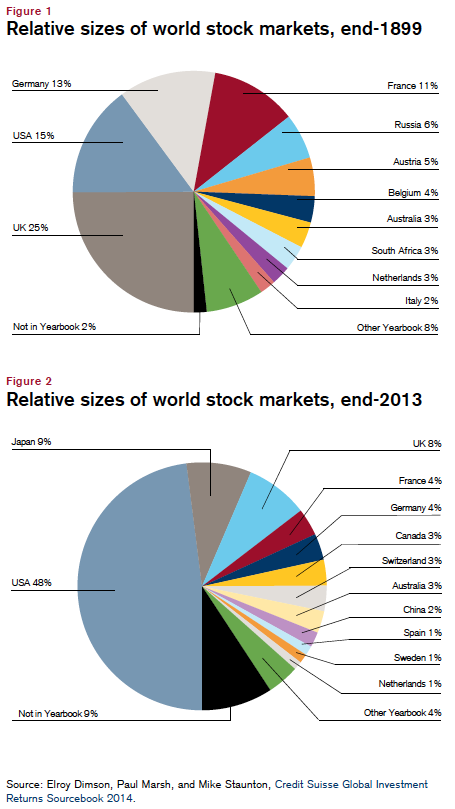

Relative sizes of world stock markets 1899 – 2013

Global Stock Market Capitalisations

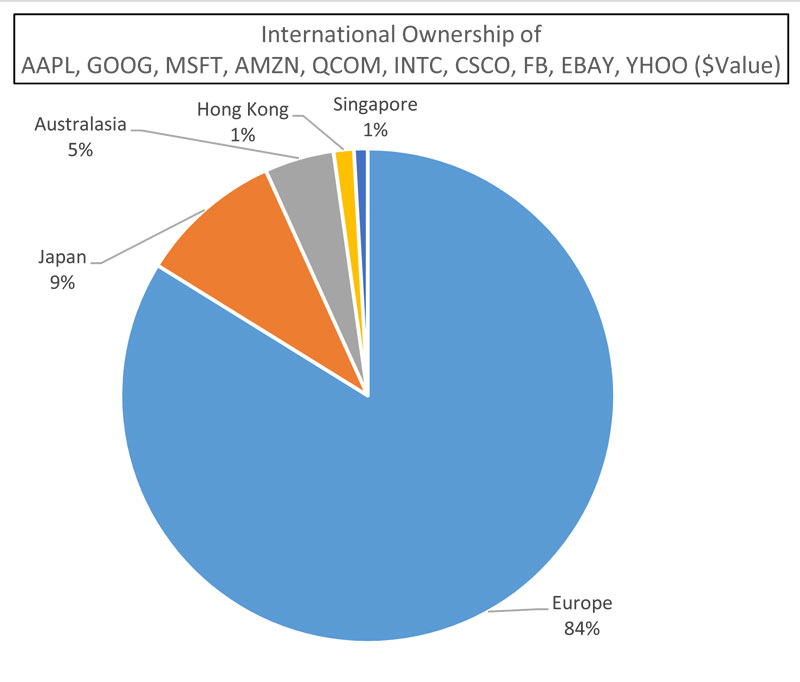

International Ownership of AAPL, GOOG, MSFT, AMZN, QCOM, INTC, CSCO, FB, EBAY, YHOO ($Value)

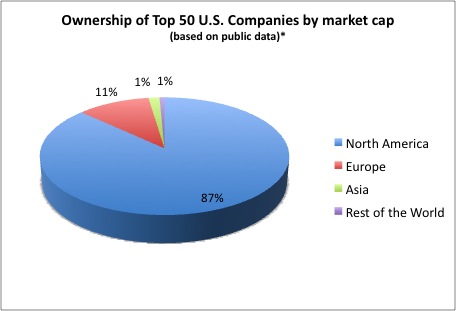

Ownership of Top 50 U.S. Companies by market cap

* Public data ex U.S. is incomplete because of poor disclosure, therefore underestimating foreign ownership

Foreign Portfolio Holdings of U.S. Securities – U.S. Treasury

Swiss Private Banking in global context

Swiss Private Banking has assets under management of SFr 5.3 trillion ($5.5 tn), half of which is on behalf of off-shore customers.

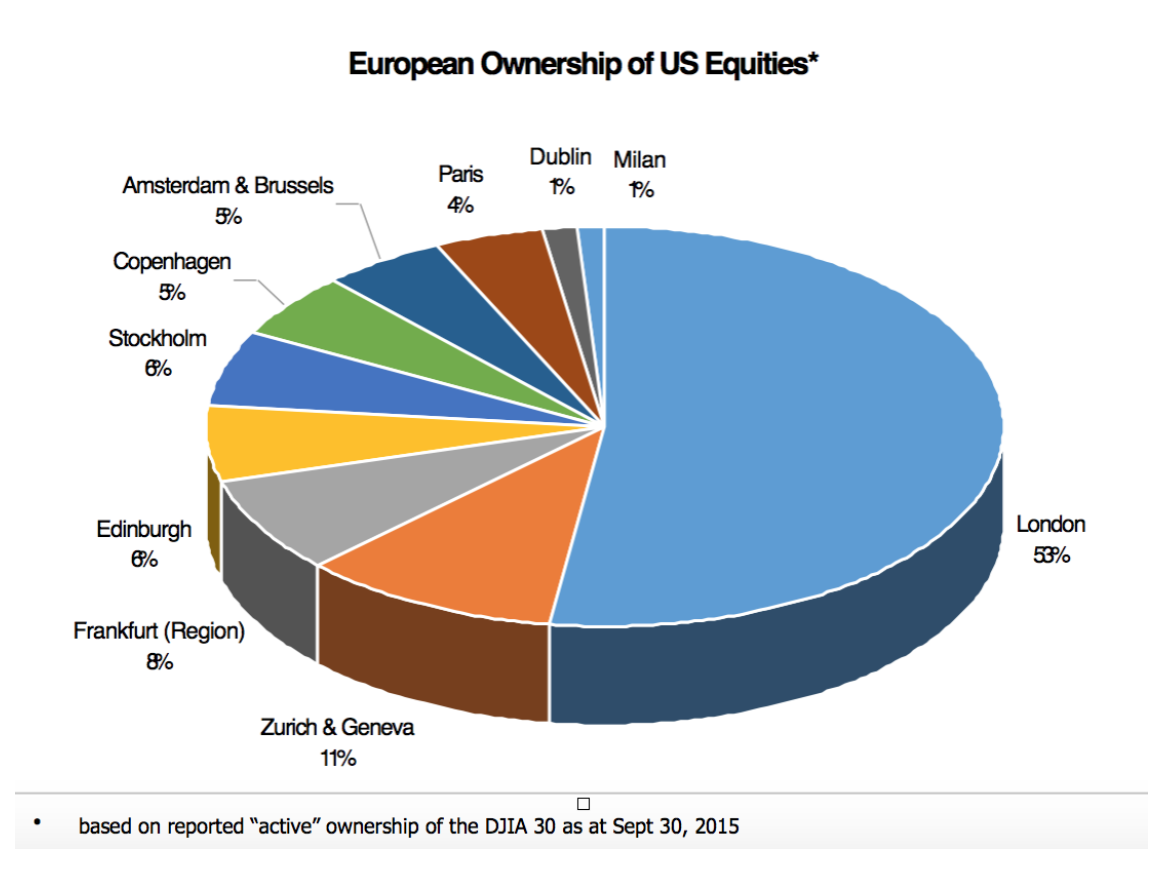

Foreign ownership of US equities

- International investors own 14% of the US equity market, the highest percentage in 68 years

- US total market cap is approx $19 trillion, so 14% = $2.6 trillion

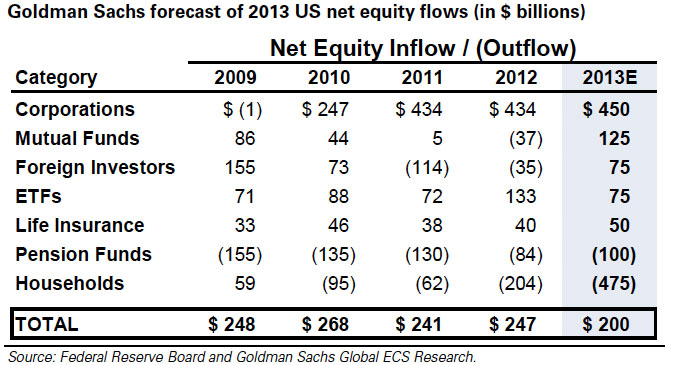

- Foreign investors will account for 37.5% of the net inflow into US equities in 2013 according to Goldman Sachs.