“The EFAMA Asset Management in Europe report aims at providing facts and figures to gain a better understanding of the role of the European asset management industry. It takes a different approach from that of the other EFAMA research reports, on two grounds. Firstly, this report does not focus exclusively on investment funds, but it also analyses the assets that are managed by asset managers under the form of discretionary mandates. Secondly, the report focuses on the countries where the investment fund assets are managed rather than on the countries in which the funds are domiciled.

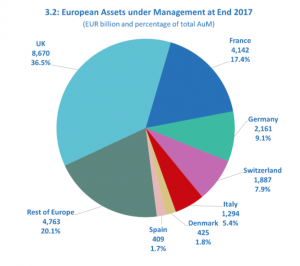

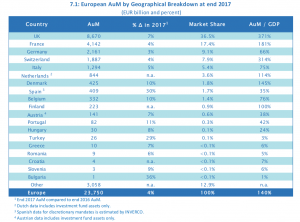

The report is primarily based on data provided by EFAMA national member associations on the value of the assets managed in their countries at the end of 2017. Twenty national member associations provided data on the value of the assets managed in their countries at end 2017: Austria, Belgium, Bulgaria, Croatia, the Czech Republic, Denmark, Finland, France, Germany, Greece, Hungary, Italy, Poland, Portugal, Romania, Slovenia, Switzerland, Spain, Turkey and the UK. According to our estimation, these countries account for 87% of the assets under management (AuM) in Europe. Additional internal and external data have been used to estimate the AuM in the other European countries.”

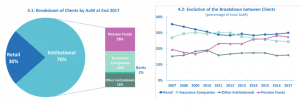

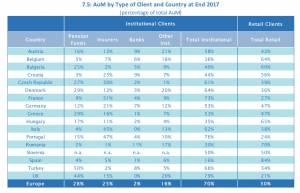

“Two remarks can be made on the evolution of the shares of the different types of clients in the total AuM managed in Europe. Firstly, the share of retail clients has increased in recent years, most likely because of the ultra-low interest rates offered on bank deposits and the return of investor confidence in capital markets instruments. However, the share of retail investors still remained lower than before the global financial crisis. Secondly, the shares of pension funds and insurance companies have evolved in opposite direction, with the share of pension funds rising and the share of insurance companies steadily declining. Pension funds have benefited to a far greater extent from the strong equity market performance because their holdings of equity in their asset allocation are greater than those of insurance companies, which are subject to Solvency II rules. The increasing share of pension funds is also driven by the strong growth of the UK pension fund sector, which has benefited from an automatic enrolment system into workplace pension schemes since 2012. The share of insurance companies has also declined because some companies decided to re-internalise the management of their plain vanilla government bonds, in order to reduce costs.”