Many market participants expected MiFID II to start slowly as the regulations rolled out over the course of this year. Many companies also have been talking about ‘business-as-usual’ with many in ‘wait-and-see’ mode. Now that a quarter has passed, what is the reality? Particularly from the buy-side’s perspective.

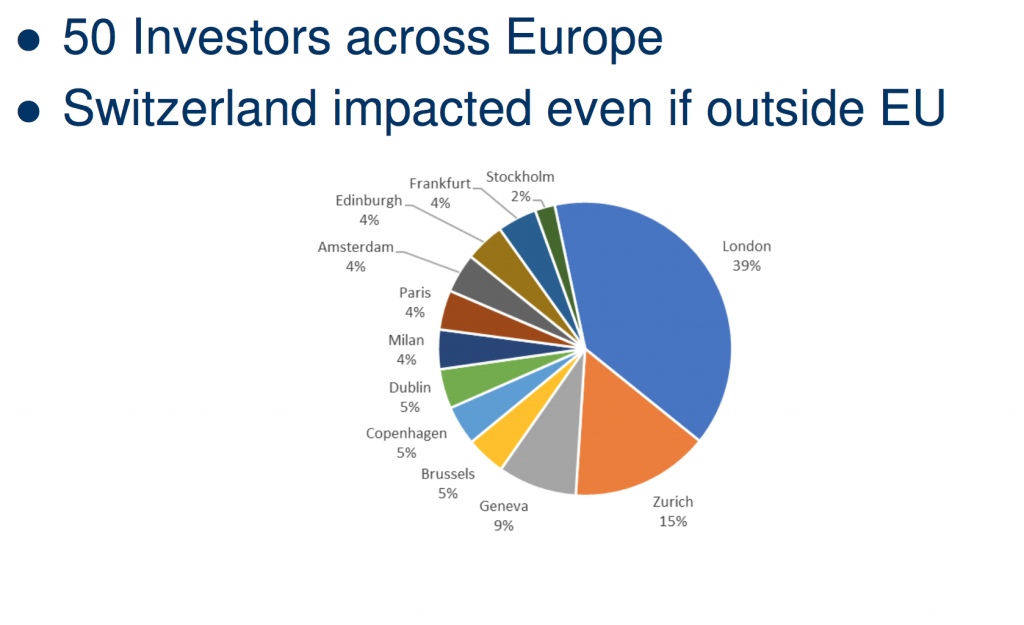

To help answer this question, we interviewed a sample of 50 European-based portfolio managers during the 11th week after MiFID II (March 19-23, 2018). Their answers painted a picture suggesting more revolution than evolution. The buy-side is clearly experiencing significant change already and it’s clearly not ‘business-as-usual’.

The results show:

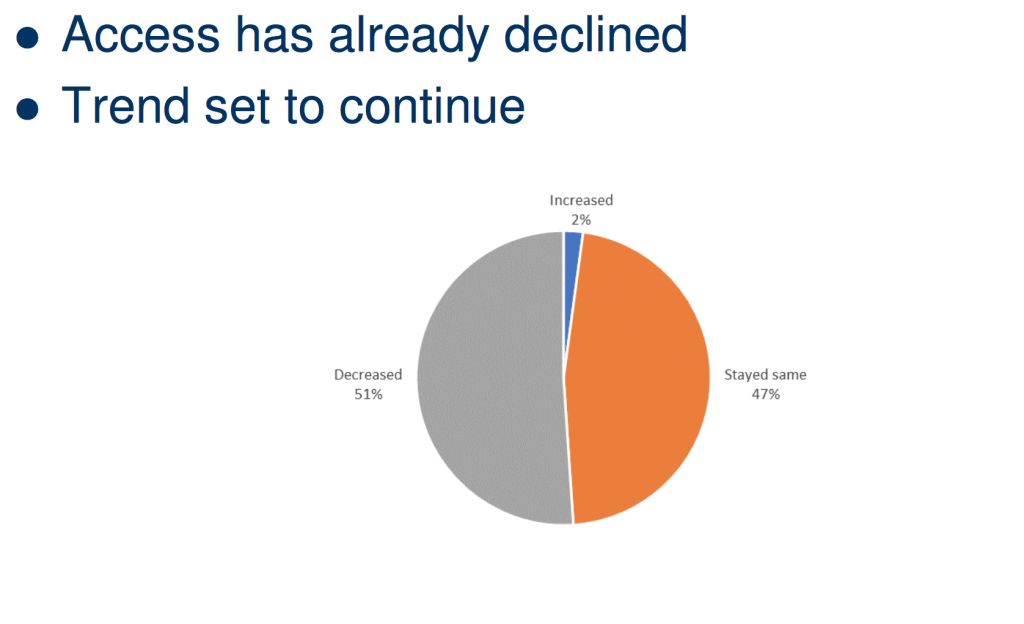

- Access has been negatively affected

- Investors have already reduced the number of brokers they are dealing with for both equity research and Corporate Access

- Cutbacks in research providers is already leading to restricted access to conferences and non-deal roadshows

- Price discovery for research is evolving quickly

- The risks of companies and investors ‘missing’ each other during roadshows has increased

- Interesting (and worrying) divergence appearing between the communication lines issuers-to-shareholders and issuers-to-non shareholders

- Buy-side is contacting more companies directly and would like company IR teams to also do more themselves

- Investors are strongly in favor of an independent model for providing Corporate Access

- Bureaucracy has increased with all interactions being logged

- Surprisingly, some buy-siders are reporting poor responsiveness from some IR teams

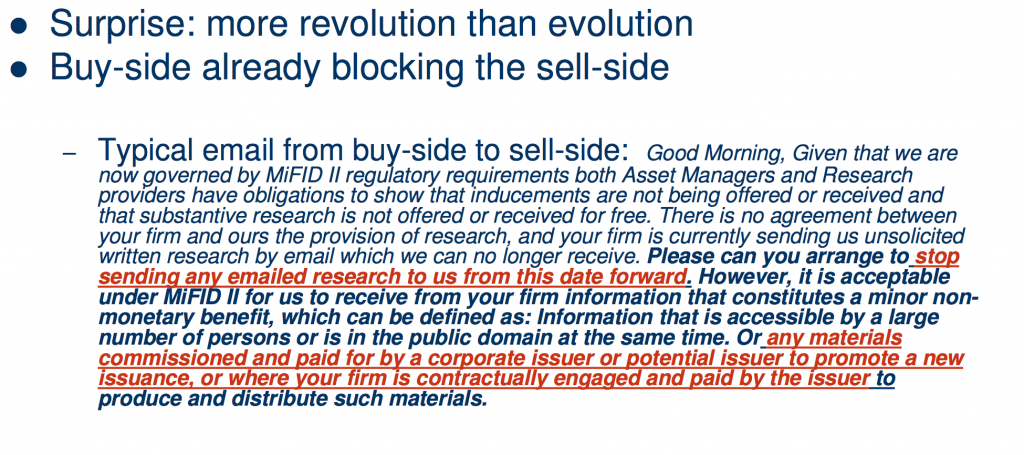

The changes started pretty immediately in January with many buy-siders issuing “cease and desist” style emails to the sell-side asking them to stop sending research unless they have a contract in place. For example, typical emails were as follows: