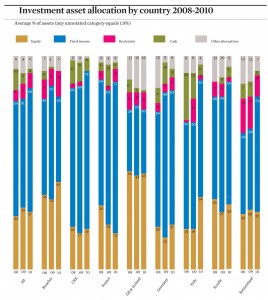

The 11th European Institutional Asset Management Survey (EIAMS), researched by Invesco, found that investors have increased their allocations to fixed income while reducing their equity exposure. The 2011 survey received responses from 148 investors in 25 countries (mainly Benelux, UK, Ireland, France and the Nordics), with total assets under management of EUR 1,194 billion, or an average of EUR 8.1 billion.

For investor relations officers at public companies we believe the most interesting points are:

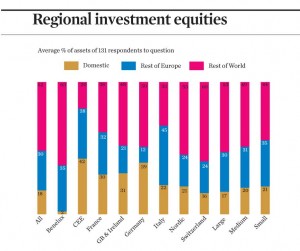

1 – European institutions invest most of their equity portfolios internationally while the bulk of their fixed income assets remain in their domestic markets.

2.- The flight to safety has continued with fixed income gaining more ground with investors, but last year’s freefall in equities appears to have been halted with just a small decline, and the sharp reduction in cash suggests that investors are less risk averse.

3. – Fixed income accounts for 58% of institutional portfolios’ assets, compared with 51% in the prior year.

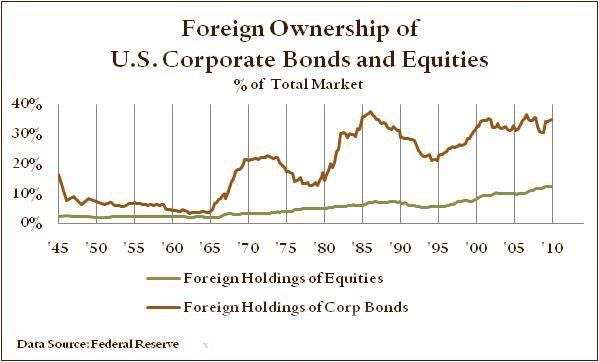

4. – Fixed income looks to gain further ground with corporate bonds the big likely winner at the expense of government debt. Indeed, 22% of investors are aiming to increase their fixed income component with 30% of investors increasing their exposure to corporate bonds and 31% reducing their government bond holdings.

5. – Allocations to equities have fallen slightly to 27%, down from 2009’s level of 29%, and well below the 32% average allocation reported in 2007. UK & Ireland remain true to their traditionally high equities weightings, with shares creeping back up to 45% of portfolios this time after slipping to 44% in 2009, though they are still below the 55% weighting seen in 2007.

6. – A small net increase in equity investment is forecast and this is most likely to occur outside of domestic markets. 19% of respondents planned to boost their equity allocations against 15% who signaled an intention to sell. More marked, though, is the likely swing away from domestic shares towards those in other European countries, the USA, Asia and other markets. Only 11% of respondents planned to increase equities from their home market, while 21% intended to up the proportion of other European equities as well as those from Asia, while 20% planned to lift USA equity allocations and 23% aimed to boost their “other markets” stock holdings. Institutions are clearly turning away from home markets in equity and fixed income investment. Average domestic equity allocation has fallen to 18% of the total equity slice from 23.5%.

Click on the charts below for a full display.