Source: https://www.ipe.com/news/asset-managers/top-400-asset-managers-2017-global-passive-assets-hit-8trn/10019389.article

Sarasin & Partners – London

Jeremy Thomas joined Sarasin & Partners in 2016 from Allianz Global Investors where he spent 12 years. Prior to this he spent three years at Isis Asset Management (now BMO Global), five years at Schroders and five years as a British Army Officer. He has a degree in PPE from Oxford University.

joined Sarasin & Partners in 2016 from Allianz Global Investors where he spent 12 years. Prior to this he spent three years at Isis Asset Management (now BMO Global), five years at Schroders and five years as a British Army Officer. He has a degree in PPE from Oxford University.

London-based Sarasin & Partners LLP manages £14.1 billion ($18.3 billion). Local management own 46% of the economic interest of the partnership with the remaining 54% owned by Basel-based Bank J Safra Sarasin Group (AUM $154bn). Sarasin & Partners manages money for domestic and overseas private clients, charities, pension funds, institutions and retail investors.

Aviva Investors – France

Matthieu Rolin joined Aviva Investors France in 2015 and covers US equities. He was previously a senior portfolio manager at SwissLife Banque Privée (2010 – 2015) and a senior fund manager at Olympia Capital (2004 – 2010). He has a Masters in Banking and Finance from Université Lumière (Lyon II) and SKEMA Bachelor.

Matthieu Rolin joined Aviva Investors France in 2015 and covers US equities. He was previously a senior portfolio manager at SwissLife Banque Privée (2010 – 2015) and a senior fund manager at Olympia Capital (2004 – 2010). He has a Masters in Banking and Finance from Université Lumière (Lyon II) and SKEMA Bachelor.

Aviva is one of the world’s largest insurance groups with global assets of >$630 billion. It is also France’s third largest multi-line insurer and has ~$50 billion under management.

How is Aviva Investors France positioned in the French investment management industry?

“We are a top 10 asset manager in France in terms of AUM. We invest in all asset classes – equities, fixed income, real estate, multi asset and some alternative investments. There are 35 in the investment team – portfolio managers and analysts and we also share resources with other Aviva offices around the world. For example, there are nine analysts in the US, eight in London, two in Singapore and one in Toronto plus the four analysts we have in Paris.”

A Match.com for Investors to Gain Corporate Access

A group of upstarts is seizing on new European Union rules to shake up banks’ matchmaking role between investors and corporate executives.

As investors prepare for EU regulations that will force them to pay for research products a la carte, one of the most valuable services is Corporate Access — the conferences, roadshows and face time with executives that can provide an information edge. Investors globally spend more than $2 billion a year for corporate access, according to consulting firm Greenwich Associates.

That spending was typically baked in to trading commissions paid to a bank. Making it a separately priced service provides a big opportunity for people like Adrian Rusling, founder of a site that counts executives at BlackRock Inc., Credit Suisse Group AG and FedEx Corp. among its users.

“It’s like Match.com,” said Rusling, who started www.CorporateAccessNet

Planning for Europe’s MiFID II rules, which take effect in January, has driven a 50 percent surge in daily user requests so far this year, Rusling said.

Link to original story: https://www.bloomberg.com/

Phoenix-IR partners with Investor Update to reveal shareholdings behind requests for Corporate Access

April 19, 2017 07:30 AM Eastern Standard Time

LONDON, NEW YORK, PARIS & BRUSSELS –(BUSINESS WIRE)–

Phoenix-IR and Investor Update announce a partnership to offer corporate clients the ability to request and receive accurate, near real-time, and detailed investor shareholding positions through Phoenix-IR’s CorporateAccessNetwork.

CorporateAccessNetwork is a social network platform enabling direct contact between institutional investors and publicly-listed companies. This partnership with Investor Update now empowers IR teams, using the CorporateAccessNetwork, to discover shareholding positions behind each institutional meeting request. This new service will help improve transparency and foster better understanding between investors and issuers.

This shareholding intelligence goes beyond public filings information, which can be out-of-date and incomplete, and instead, leverages the power of bespoke research to provide the most up-to-date pre-meeting shareholding data and qualification available to corporates today.

The combination of Phoenix-IR’s CorporateAccessNetwork platform and Investor Update’s transparency into shareholdings gives IR teams a faster, laser-like resource for investment community engagement.

Adrian Rusling, Partner at Phoenix-IR, said “We’re delighted to add Investor Update to Phoenix-IR’s CorporateAccessNetwork.com. Public ownership data is widely available already but we can now take this to a new level by making the connection between Corporate Access interest and ownership on a near real-time basis. This adds significant value to the targeting power of the CorporateAccessNetwork platform and enriches the user experience by providing more insight for IROs. The team at Investor Update is one of the most experienced in the marketplace today and their expertise complements our drive to create a truly open global market place for Corporate Access.”

Patrick Mitchell, Co-Founder & Managing Partner, said “Phoenix-IR’s CorporateAccessNetwork is a platform based solution that enables institutional investors to connect with publicly-listed companies. With the advent of a post MiFID II world almost upon us and with management and IR time always at a premium, we are excited to offer the combination of Phoenix-IR’s established network of investors and Investor Update’s enhanced approach to precision shareholder intelligence. This will allow corporates to prioritise and direct investor outreach in an even more focused manner”.

About Investor Update

Founded by industry veterans, Patrick Mitchell and Tasos Constantinou have combined experience of over 50 years providing sophisticated products and solutions to corporate issuers and the financial community. Investor Update assist their clients in navigating the complex world of global custody and targeting and tracking key investor holdings with timeliness and pinpoint accuracy, giving a unique insight into key shareholder movements in the equity and debt markets. With offices in London and New York, Investor Update provides strategic solutions to corporates, corporate access and transactional teams, proxy solicitation firms and IR & PR agencies.

For more information visit www.investor-update.com

About Phoenix-IR

Founded in 2005, Phoenix-IR is a leading European-based investor relations consulting firm specializing in Targeting, Roadshows and Perception Research services for publicly listed companies. Phoenix-IR launched its CorporateAccessNetwork.com platform in 2013 and it has already processed more than 75,000 meeting requests from more than 1,000 institutions for 2,000 publicly listed corporations. In the new regulatory environment being shaped by the FCA and MiFID II, CorporateAccessNetwork is a smarter way for investors and companies to connect directly, using modern technology.

For more information visit www.Phoenix-IR.com and www.CorporateAccessNetwork.com

Contacts

Investor Update

Patrick Mitchell, Managing Partner

Phone: +44 20 3371 1916

Email: pmitchell@investor-update.com

Phoenix-IR

Adrian Rusling, Partner

Phone: +322 626 10 51

Email: adrian.rusling@phoenix-ir.com

Close Brothers Asset Management – London

Robert Alster joined Close Brothers Asset Management in 2014 as Head of Research. He also is responsible for research coverage of three equity sectors: global autos, aerospace and construction companies.

Robert Alster joined Close Brothers Asset Management in 2014 as Head of Research. He also is responsible for research coverage of three equity sectors: global autos, aerospace and construction companies.

Prior to joining Close Brothers Asset Management, Robert was head of European and UK Growth Equities at AllianceBernstein, where he worked between 2003 – 2013. Prior to that, he worked at UBS Brinson, American Express Asset Management, and Fleming Investment Management. He also has eight years of experience within industry.

Close Brothers Group plc is a leading UK merchant banking group listed on the London Stock Exchange. The business was founded in 1878 by William Brooks Close, initially providing farm mortgages in Iowa and financing the first railway in Alaska. Its asset management division, Close Brothers Asset Management (CBAM) has AUM of £10billion and manages assets for private clients and their families, institutions, charities and foundations.

Describe Close Brothers Asset Management

“We see ourselves as an active, global, multi-asset private wealth manager, with experienced investment professionals operating within an institutional investment framework.”

PRESS RELEASE

Anticipating MiFID 2, ResearchPool and CorporateAccessNetwork launch the first digital solution enabling disintermediated access to equity research and Corporate Access

April 7, 2016, London, Paris, Brussels – ResearchPool, a financial research platform, and CorporateAccessNetwork, a platform enabling direct contact between institutional investors and publicly listed companies, announce a partnership to offer the investment community the first digital solution combining equity research and Corporate Access.

The institutional investor users of each platform are one click away from being able to access investment research and connect with listed companies in order to complement their investment decision making processes without having to pass through an intermediary. As a response to the new regulatory framework already introduced in the UK since May 2014 by the FCA (Financial Conduct Authority) and anticipated in MiFID 2, ResearchPool and CorporateAccessNetwork are the first platforms to offer such a transparent, on-demand service.

As a result of this agreement ResearchPool offers its clients the opportunity to complement the research on listed companies available on its platform, by allowing investors direct access to corporate management via CorporateAccessNetwork. Reciprocally, CorporateAccessNetwork, which enables investors to interact directly with investor relations departments and organize management meetings with listed companies, now offers investors access to the entire body of financial research content available on ResearchPool.

Through links developed between the two platforms, investors conducting research on a listed company are able to quickly access financial research on the given company and link directly with its management.

This combined service is a response in anticipation of the upcoming European Directive MiFID 2. As of January 3, 2018, it is anticipated that the costs borne by the customers of investment management firms to have access to research and Corporate Access will be decoupled from brokerage commissions, thus improving transparency with better disclosure to customers and reduced conflict of interest.

Pedro Fernandes, co-founder and CEO of ResearchPool comments, “Direct contact with the management of listed companies is a major element of added value much demanded by professional investors, and it is highly complementary with access to financial research. Prior to the application of MiFID 2 we are offering investors a new approach to combine these two services within a powerful, efficient and simple solution as a result of the partnership we’re announcing today.”

Adrian Rusling, co-founder at Phoenix-IR, operator of the CorporateAccessNetwork, comments, “Investors who visit our platform for Corporate Access can now connect to ResearchPool’s impressive body of research content. We believe this is exactly what the investment community has been waiting for and we are excited to be the first in the world to offer a combined service of this kind.”

About ResearchPool:

ResearchPool is an innovative digital platform that contributes to the transformation of the business model of financial research. Launched on July 6th 2015, ResearchPool plays a central role in linking producers of research and their customers who, with the impetus of MiFID 2 will move from being passive users to active consumers. ResearchPool offers investor-buyers direct and easy access to a comprehensive range of research which can be purchased online in full transparency and to be part of a community. ResearchPool offers the creators of research the opportunity for worldwide distribution to various target audiences not related to trading and the digital marketing of this content which increases the visibility and monetization potential of their expertise at prices established by the market. To date, ResearchPool has distributed 26,000 reports on more than 7,000 instruments from 70 different research providers in 80 countries. Site: www.ResearchPool.com

Media contact: Antoinette Darpy – toBnext – Tel. +33 6 72 95 07 92 – adarpy@tobnext.com

About CorporateAccessNetwork.com:

CorporateAccessNetwork (CAN) was created in 2014 by Phoenix-IR, an independent investor relations firm, to help investors and listed companies communicate with each other directly and more efficiently. As an independent, open platform, CAN has already processed more than 55,000 requests from more than 900 institutions to meet with 1,800 public listed companies from Europe and the Americas. CorporateAccessNetwork is a free service for the investment community. Listed companies can use the service for free or subscribe to the premium service. Site: www.CorporateAccessNetwork.com

Media contact: Adrian Rusling, Partner – Tel: +32 2 626 1050 – adrian.rusling@phoenix-ir.com

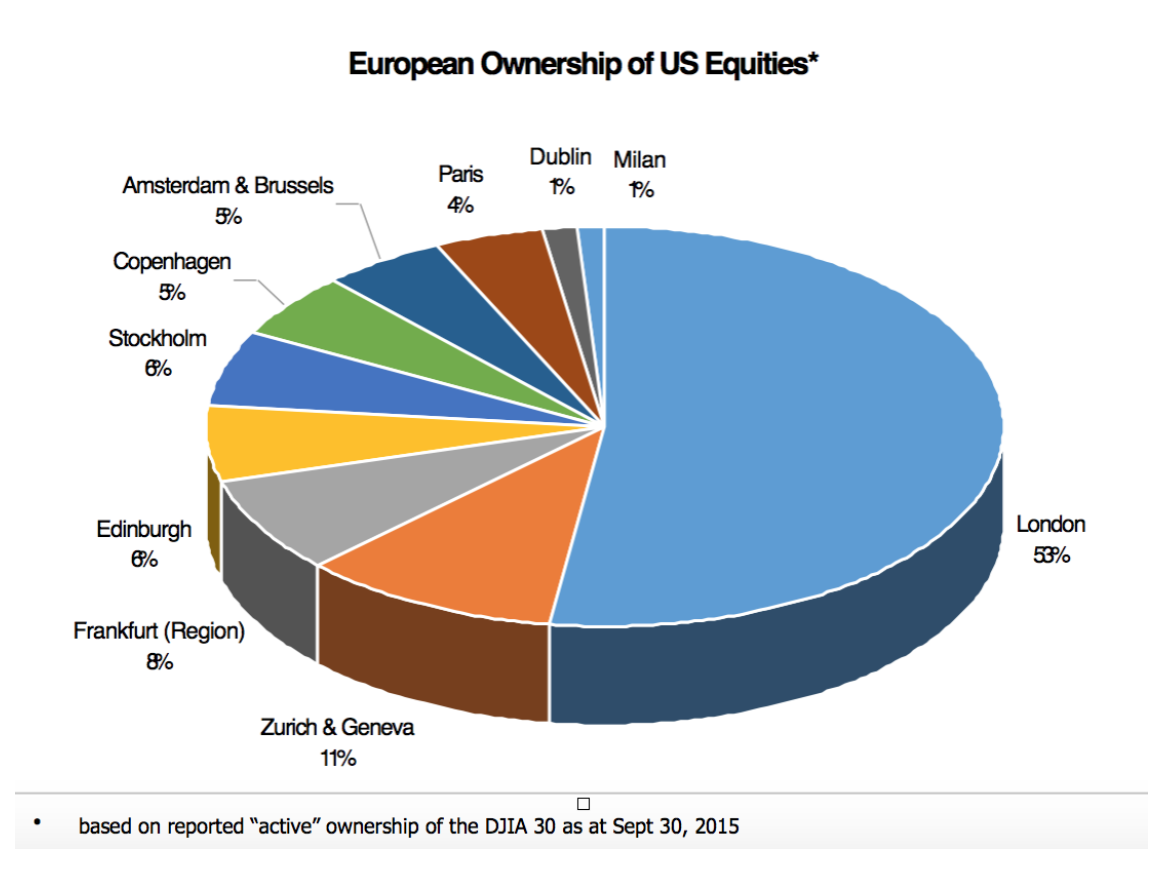

European Ownership of US Equities

FCA’s stance on Corporate Access

The FCA’s Marc Teasdale (Head of the UK Listing Authority, FCA) delivered a speech entitled Investor engagement in a changing regulatory landscape at the Investor Relations Society Conference in London on 23 June 2015.

Here are some extracts regarding the FCA’s stance on Corporate Access:

“Back in 2012, an FSA supervisory review of conflicts of interest in the asset management sector uncovered the increasing use of dealing commissions to pay for this access. When we looked at this issue in detail, we had concerns that using this transaction cost mechanism to pay for access favoured firms generating the highest execution commissions with a broker, so potentially those trading more frequently, rather than the best long-term investors for the issuer.

We also found that amounts paid for meetings through dealing commission – which of course are costs the investment manager passes on to its clients in addition to management fees – were often much higher than similar services offered by non-broker third parties. We were also clear that the service provided did not meet our criteria for research that can be acquired with dealing commission.

We therefore clarified in May last year that dealing commission cannot be used to pay for corporate access. It is important to stress here that we were not banning corporate access itself, as we recognise that engagement between issuers and investors can be an important component of effective investor stewardship.

Investment managers can still pay for corporate access directly. But by removing the link with dealing commissions, we think this process, and the costs it involves, will be both more transparent and less impacted by potentially competing incentives. Since clarifying our rules, we have seen firms taking steps to better manage costs and conflicts of interest in this area, as well as innovation to facilitate more direct access between investors and issuers.”

————————-

“Our policy analysis and response on this subject, being closely informed by the results of this review, supported the principle of further separating the acquisition of research by investment managers from the dealing commission mechanism. In our view this would produce a number of positive outcomes including:

- the reform of market practices which are currently subject to inherent conflicts of interest

- greater transparency over the use of investors’ funds, which in turn should lead to increased accountability in the use of those funds – both for research, and when assessing the costs of executing trades

- and the creation of a more level playing field in the market for the provision of research, allowing a greater range of market participants to provide offerings more closely matched to the needs of clients

Of course, the debate in relation to the connection between research and dealing commission has now very much moved to the European stage, due to the development of proposals under MIFID II.

ESMA provided its final advice to the European Commission in December 2014 on detailed proposals to support the new MIFID II Directive, including in the area of research and inducements. Under ESMA’s final proposals, an investment manager can purchase research provided it is paid for either directly by the firm out of its own resources, or through a ‘research payment account’ funded by a specific, separate charge to their client, which is agreed and disclosed upfront. This charge must be based on a research budget set by the client, and cannot be linked to execution volumes or value.

We anticipate that the Commission is likely to adopt the proposals by the summer, which will then be subject to formal scrutiny by the Parliament and Council. We will then need to put the final proposals into our domestic legislation and rules, and we hope to consult formally on this by the end of the year.

Whilst the nature of research that can be paid for via the new ‘research payment account’, and so charged to clients, is likely to depend on the final Commission text or potentially future ESMA guidelines, our view is that corporate access will remain a service that should be paid for directly by the investment manager.

We remain supportive of these EU proposals, as we believe they would significantly improve the accountability of investment managers over their procurement and use of external research on behalf of their customers, leading to better controls of costs in the sector. This is not about cutting research spending or undermining EU asset managers’ competitiveness, but rather about ensuring investment managers buy the right research, at the right price, and are open and transparent with their customers on the costs they will charge on to them.

We think the proposed reforms will lead to a more efficient allocation of resources toward research that adds the most value to asset managers’ investment decisions. This should create a clear opportunity for research from more specialised providers, including in the coverage of SMEs. Unbundling fees and services by brokers will enable proper pricing and competition in the research market, which should result in better products and services from a more diverse array of providers than under the current model.”

Link to the full speech: https://www.fca.org.uk/news/investor-engagement-in-changing-regulatory-landscape

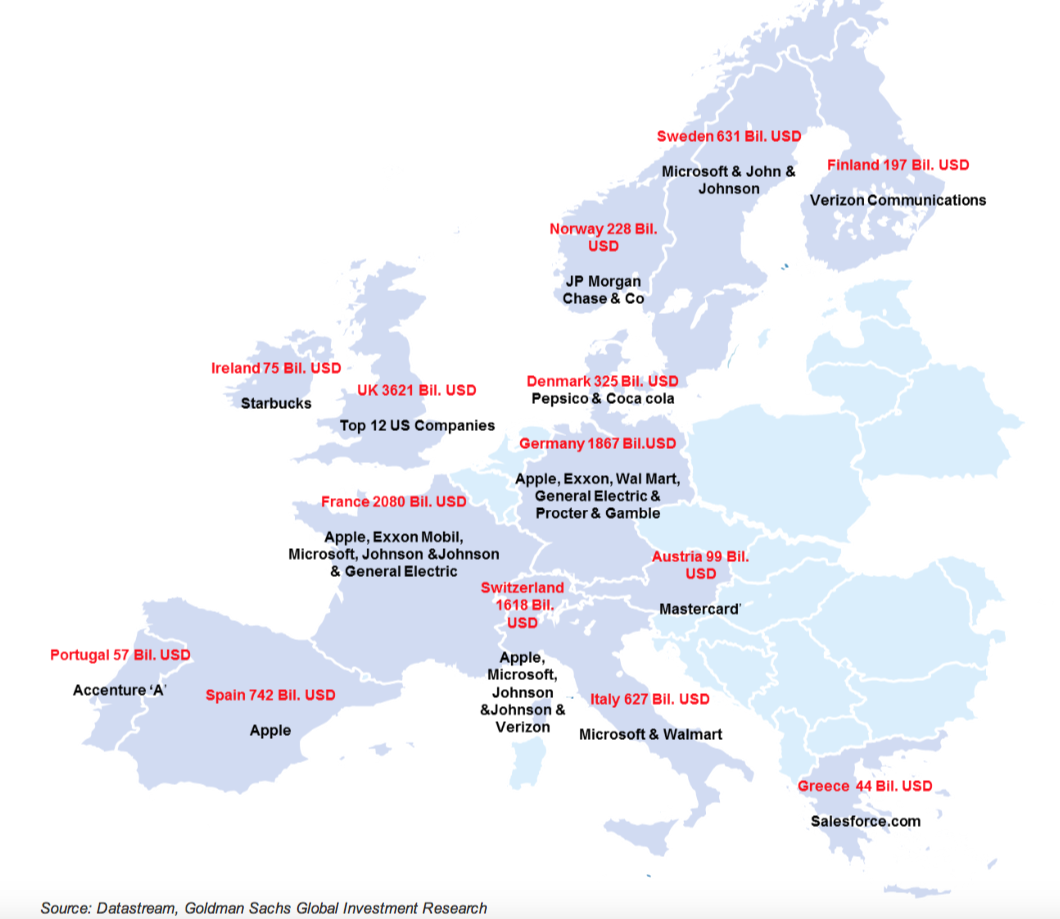

Goldman Sachs Market Cap comparison – U.S. vs. Europe

Goldman Sachs has made some interesting observations about the relative sizes of U.S. companies compared to Europeans.

Here are some light hearted comparisons (based on total market capitalisation data)

- Apple alone is the same size as the whole Spanish equity market and bigger than Italy.

- The whole Italian stock market is worth about the same as Walmart and Microsoft combined the S&Ps 3rd and 6th biggest companies

- The German equity market (Europe’s biggest economy) is no bigger than the S&Ps 4 biggest companies

- The 40 biggest French companies (the CAC40) is no bigger than the US top 5

- Greece is no bigger than Salesforce.com, a company that has been public for a little over 10 years

- Starbucks is the same market capitalisation as the whole of Ireland

A US equity map of Europe – US companies shown in each country equate to the size of total market capitalization in the country Europe’s 600 biggest companies (the Stoxx600) are less than half the size of the S&P 500.

Europe’s 600 biggest companies (the Stoxx600) are less than half the size of the S&P 500.

It’s also interesting that even in the context of Europe the Swiss market alone is bigger than Spain and the Netherlands combined. The UK 100 biggest companies (FTSE 100) are bigger than the CAC and Dax put together.